Loan Comparison Tool

Transparency Is Everything When It Comes To Lending

Before you sign on the dotted line, Business Capital Resource makes it simple to comprehend your loan conditions.

We support openness regarding business loans and want you to be well-informed when choosing how to fund your company. It can often be challenging to compare loans since different lenders convey pricing in different ways.

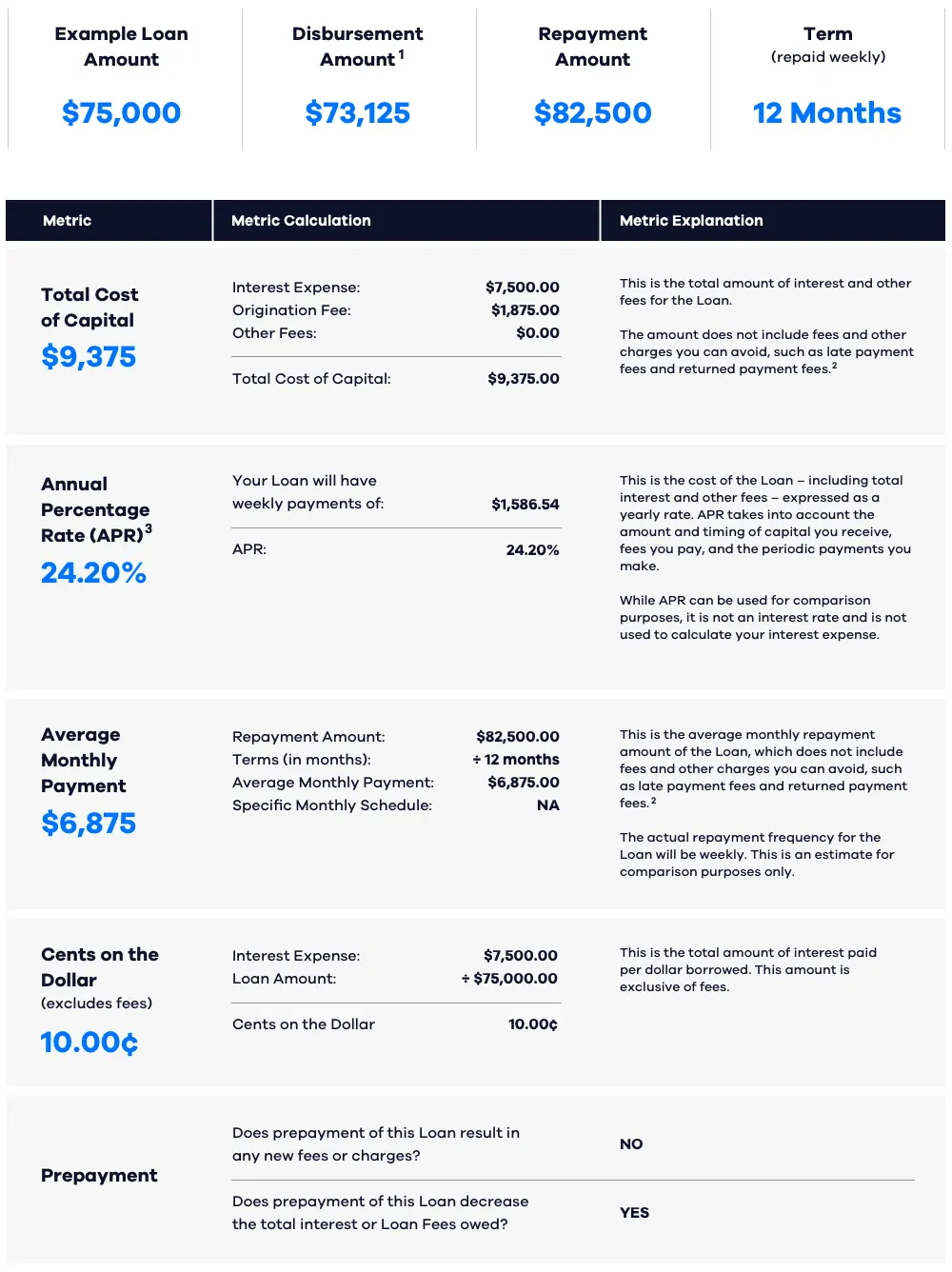

Business Capital Resource explains the main words you need to understand in plain English and an accessible format so that you can assess possible loan offers. A disclosure form called the SMART Box® offers a thorough, standardised summary of your cost of capital.

When you receive a Company Capital Resource offer, this tool is made available to you to assist you in understanding and evaluating the cost of your small business funding.

¹ The Disbursement Amount is the amount of capital that a business receives and may be different from the Loan Amount. The Disbursement Amount is net of fees withheld from the Loan Amount. A portion of the Disbursement Amount may be used to pay off any amounts owed from a prior loan or an amount owed to a third party.

² Your business may incur other fees that are not a condition of borrowing, such as late payment fees, returned payment fees, or monthly maintenance fees. Those fees are not reflected here. See your loan arrangement for details on these fees.

³ APR should be considered in conjunction with the Total Cost of Capital. APR may be most useful when comparing financing solutions of similar expected duration. APR is calculated here according to the principles of 12 C.F.R. § 1026 (Regulation Z), using 52 payment periods of equal length and 52 payment dates per year for weekly pay products.

© 2017 Innovative Lending Platform Association. All rights reserved. Innovative Lending Platform Association is not responsible for any misuse of the SMART Box® or any inaccuracies in the calculations or information included therein.